A state-chartered Commercial Silicon Valley Bank (SVB) in the United States collapsed suddenly in march 2023, also marked as the most significant bank failure. Since 2008 financial crisis has sent shockwaves across global financial markets. The US regional banks came under particularly intense pressure as concern grew among customers and investors about the financial health of other institutions; however, revelations are made hour by the hour about United states banking and its most relevant things.

A Hongkong based journalist and author Nury Vittachi shared some essential information on his social media account about the current banking panic.

The essential things given about the current banking panic are :

1. Silicon Valley Bank, Signature Bank, and Silvergate Bank have shut down. SVB was among America’s top 20 largest banks but collapsed in 48 hours. It’s believed to be the second biggest banking collapse in the country. People are expected to queue outside other banks from this morning onwards.

2. As a result, bank shares everywhere have been falling – including those of big banks like HSBC in the UK, Europe and elsewhere.

This means people can take their time getting their money out and hide it in their mattresses. The analysts do not consider significant banks to be in trouble yet.

They mean that people’s savings, including their unit trusts, shares, pension funds, etc., may take a hit from falling share prices.

3. A knowledgeable Hong Kong source said that many of SVB’s clients were the most innovative companies in the US and needed to be rescued urgently. An estimated 65,000 venture capital-funded start-ups in the US were customers of SVB.

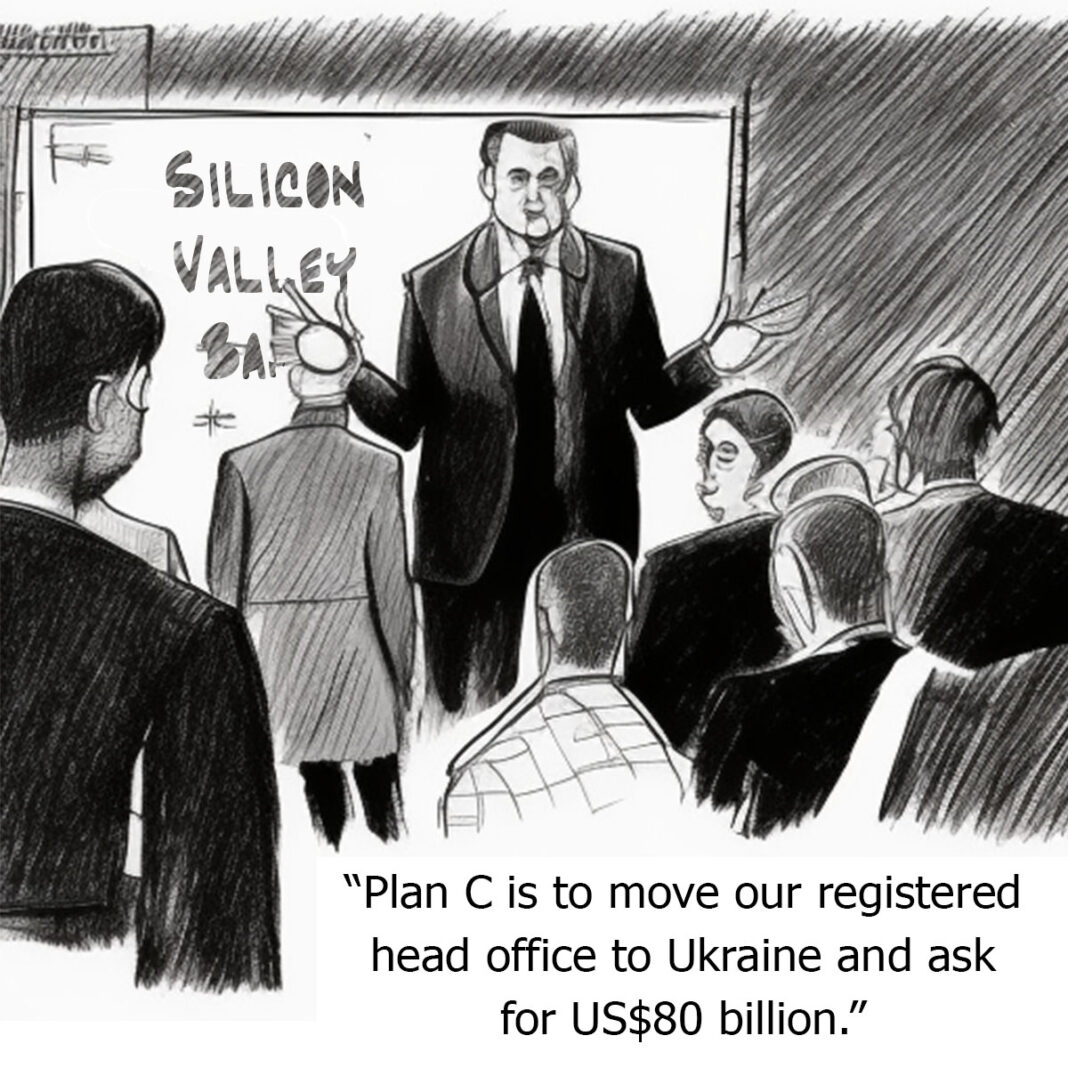

4. This is a big problem for Joe Biden’s administration—the public is angry about bailouts of financial institutions, which it opposes – but if banks are allowed to fail, the public will panic, spreading more bank runs.

The administration has said that no account holders will lose their money but have yet to say who will pay the debts. Also, they can’t make sweeping promises because they don’t know how far the contagion will spread. There are a lot of small banks in the US.

5. Silicon Valley Banks Chief Administrative Officer Joe Gentile was the CFO of Lehman Brothers’ Global Investment Bank when it collapsed. He must feel unlucky.

6. Some SVB executives sold their shares recently and are already accused of cashing out to protect themselves. Reports say staff received bonuses on Friday, hours before regulators took over the bank.

7. Elon Musk has said he is open to taking over SVB and turning it into an online bank. But I couldn’t find anyone taking it seriously. Others have expressed interest in buying it – and then backed away.

8. America’s current mindset, which angrily over-politicizes everything, will turn this into an effective finger-pointing exercise that will damage both parties. Already the Dems are blaming the Repubs, and the Repubs are blaming the Dems.

9. Expect a fall in the dollar and a rise in gold prices. Peter Schiff of Europac on Thursday predicted a new financial crisis and more QE (printing money to pump into the system)—and seems to have been bang on target.

10. A surprising reversal in the FED’s program to keep raising interest rates could affect markets worldwide. Hong Kong, which ties its interest rates to that of the US, could see a boost in property prices, which have slumped recently.